Introduction – The Rise of Digitalization in Modern Banks

The financial landscape has undergone an end-to-end transformation, within the digital spectrum with significant technological advancements shaping the industry. This shift towards digitalization has revolutionized the way consumers interact with their banks, offering convenience, accessibility, and personalized experiences.

Digital banking encompasses a wide range of services and platforms that allow users to manage their finances through digital interfaces. From checking account balances to transferring funds and applying for loans, digital banking offers a comprehensive suite of services that can be accessed anytime, anywhere. The rise of digital-only banks and fintech startups has further accelerated this adoption, challenged traditional banking models and pushed the industry towards innovation.

So, it should be no wonder that the modern customers prefer a digital conversational interface while interacting with their bank for addressing customer queries, gaining new product information, or engaging in specific actions such as ordering checkbooks, or applying for a new loan.

Shift in Consumer Preferences Towards Conversational Channels

Today’s consumers, particularly millennials and Gen Z, are digital natives who prioritize convenience, speed, and flexibility in their banking experiences. The ability to bank on-the-go, without the constraints of standing in long queues to have their queries resolved, has made conversational chatbots increasingly appealing to a broad spectrum of users. Moreover, the new normal has further accelerated this shift, with many consumers turning to conversational bots as a more convenient alternative to in-person banking.

What is Conversational Banking?

Conversational banking is revolutionizing the way customers interact with their banks, offering a more intuitive and engaging user experience through natural language conversations. Conversational banking uses AI-powered chatbots and virtual assistants to facilitate real-time conversations between customers and banks. This technology allows users to perform various banking tasks, such as checking account balances, transferring funds, and obtaining financial advice, through natural language interactions. The evolution of conversational banking has been driven by advancements in AI and machine learning, enabling banks to offer more interactive and personalized services to their customers.

Importance of Personalized Customer Interactions

Personalization is at the heart of conversational banking, offering tailored experiences that meet the unique needs and preferences of individual customers. By leveraging behavioral attributes of the customer, conversational banking delivers personalized recommendations, insights, and solutions. This level of personalization not only enhances customer satisfaction but also fosters loyalty and strengthens customer relationships.

Role of Gen AI and Chatbots in Conversational Banking

Gen AI-powered chatbots play a pivotal role in conversational banking, acting as virtual assistants that can understand, process, and respond to user queries in real-time. These intelligent chatbots are equipped with natural language processing (NLP) capabilities, enabling them to interpret user intent and provide accurate and relevant information or assistance. They can handle a wide range of tasks, from answering frequently asked questions to assisting with complex banking transactions, all while offering a seamless and intuitive user experience.

Decoding Conversational Chatbots: The Tech Behind the Talk

Chatbots have become an integral part of the modern banking ecosystem, transforming customer interactions and streamlining service delivery. But what powers these virtual assistants, and how do they facilitate seamless conversations with users? Let’s dive into the technology that drives conversational chatbots.

Popping the Hood: What Powers Chatbots?

At its core, a chatbot is a software application designed to simulate human conversation, typically through text-based or voice-based interactions. The technology that enables this capability is known as Natural Language Processing (NLP). NLP allows chatbots to understand and interpret human language, enabling them to process user queries, extract relevant information, and generate appropriate responses. This advanced technology leverages machine learning algorithms to continuously learn from user interactions, improving accuracy and efficiency over time.

Key Features and Functionalities of Conversational Chatbots

Conversational chatbots come equipped with a range of features and functionalities designed to enhance user engagement and streamline banking operations. Some key features include:

- Tailored Interactions: Tailored responses based on user behavior and preferences, offering a personalized banking experience.

- Multi-channel Support: Seamless integration across various digital platforms and devices, ensuring consistent service delivery.

- 24/7 Availability: Round-the-clock customer support, providing instant assistance and enhancing customer satisfaction.

- Security and Compliance: Robust security measures and compliance with regulatory standards to safeguard user data and transactions.

Understanding the technology behind conversational chatbots is essential for banks and financial institutions looking to leverage these powerful tools to enhance customer engagement, streamline operations, and drive digital transformation in the banking industry. Whether it’s rule-based or Gen AI-powered, chatbot technology continues to evolve, offering innovative solutions that redefine the future of banking.

Transformative Potential: Why Banks Must Embrace Gen AI for Customer Service

Traditional banking is grappling with several customer-facing challenges that impede seamless interactions and satisfaction. From extended wait times and impersonal services to limited accessibility and lack of personalized experiences, these issues underscore the pressing need for innovation in customer-facing operations. Gen AI technology emerges as a transformative solution, offering promising enhancements to address these challenges and redefine customer engagement in banking.

Customer-Facing Challenges in Traditional Banking

Traditional banking services often fall short of meeting the dynamic expectations of today’s customers. Some of the prevalent customer-facing challenges include:

- Extended Wait Times: Customers frequently face prolonged wait times, whether it’s queuing at branches or waiting for responses to inquiries, leading to frustration and dissatisfaction.

- Impersonal Services: The lack of personalized services and interactions often makes customers feel like just another account number rather than valued clients.

- Limited Accessibility: Traditional banking hours and limited access to services can pose inconveniences, restricting customers from managing their finances on their terms.

- Inconsistent Customer Experience: Disparities in service quality across different touchpoints can result in an inconsistent and disjointed customer experience.

There was indeed a moment when banks embraced a traditional rule-based chatbot. But a singular rule driven chatbot is not enough for modern tech savvy individuals. Why? Check out the key difference between them.

Differences Between Rule-based and Gen AI-powered Chatbots in Banking

| Feature | Rule-based Chatbots | Gen AI-powered Chatbots |

| Flexibility | Limited by predefined rules | Adaptable to complex queries and context |

| Personalization | Generic responses | Tailored interactions based on user behavior and preferences |

| Learning Capabilities | Limited learning from interactions | Continuous learning and adaptation to user needs |

| Query Complexity | Struggles with intricate queries | Handles complex banking inquiries with ease |

Improvements in Customer-Facing Operations Through Gen AI Technology

Gen AI technology presents a plethora of opportunities to revolutionize customer-facing operations and elevate the banking experience. Some of the key improvements include:

- Enhanced Customer Experience: Gen AI-powered chatbots and virtual assistants offer instant, personalized assistance, addressing customer queries and concerns promptly, thereby enhancing overall satisfaction and loyalty.

- 24/7 Availability: With Gen AI, banks can provide round-the-clock customer support, ensuring uninterrupted service and meeting the demands of customers who prefer digital interactions outside traditional banking hours.

- Guided Actions: Gen AI can facilitate guided actions, assisting customers through complex processes such as loan applications, account management, and financial planning, making these tasks more manageable and less daunting.

- Efficient Query Resolution: Automation of routine inquiries and processes through Gen AI can streamline customer interactions, reducing wait times and improving efficiency in handling customer requests.

Implementing Gen AI offers a compelling case for banks to prioritize innovation in customer-facing operations. By addressing the challenges inherent in traditional banking and embracing the opportunities presented by Gen AI, banks can deliver superior customer experiences, foster loyalty, and position themselves for success in the digital era.

Omnichannel Interface: Seamlessly Navigate Across Channels

With Kea’s omnichannel interface, users can seamlessly navigate across channels and devices, ensuring a consistent and intuitive user experience. Whether you’re accessing Kea via desktop, mobile, or tablet, the interface adapts to your device and preferences, ensuring a seamless and cohesive experience across channels. With Kea, you can access insights wherever you are, whenever you need them, driving productivity and efficiency.

Agile Data Access: Responding Quickly to Changing Business Needs

Kea enables agile data access, allowing users to respond quickly to changing business needs and market dynamics. Whether it’s monitoring key performance indicators (KPIs), tracking customer interactions, or detecting emerging trends, Kea provides real-time insights that enable agile decision-making and course correction. With Kea, you can stay ahead of the curve and capitalize on opportunities as they arise, driving growth and success.

Reduced Total Cost of Ownership (TCO): Maximizing ROI and Efficiency

By streamlining data access, enhancing collaboration, and driving innovation, Kea helps organizations reduce their total cost of ownership (TCO) for BI solutions. With its low-code development and intuitive interface, Kea accelerates time-to-insight and minimizes the need for IT support, reducing operational costs and maximizing ROI. With Kea, you can achieve more with less, driving efficiency and profitability.

Diverse User Base: Meeting the Needs of Every User

Kea caters to a diverse set of users, ensuring that everyone within the organization can leverage the power of data analytics. Whether you’re a frontline employee, a business analyst, or a C-level executive, Kea provides the tools you need to access insights, drive innovation, and make informed decisions. With Kea, every user can unlock the full potential of data, driving success and growth.

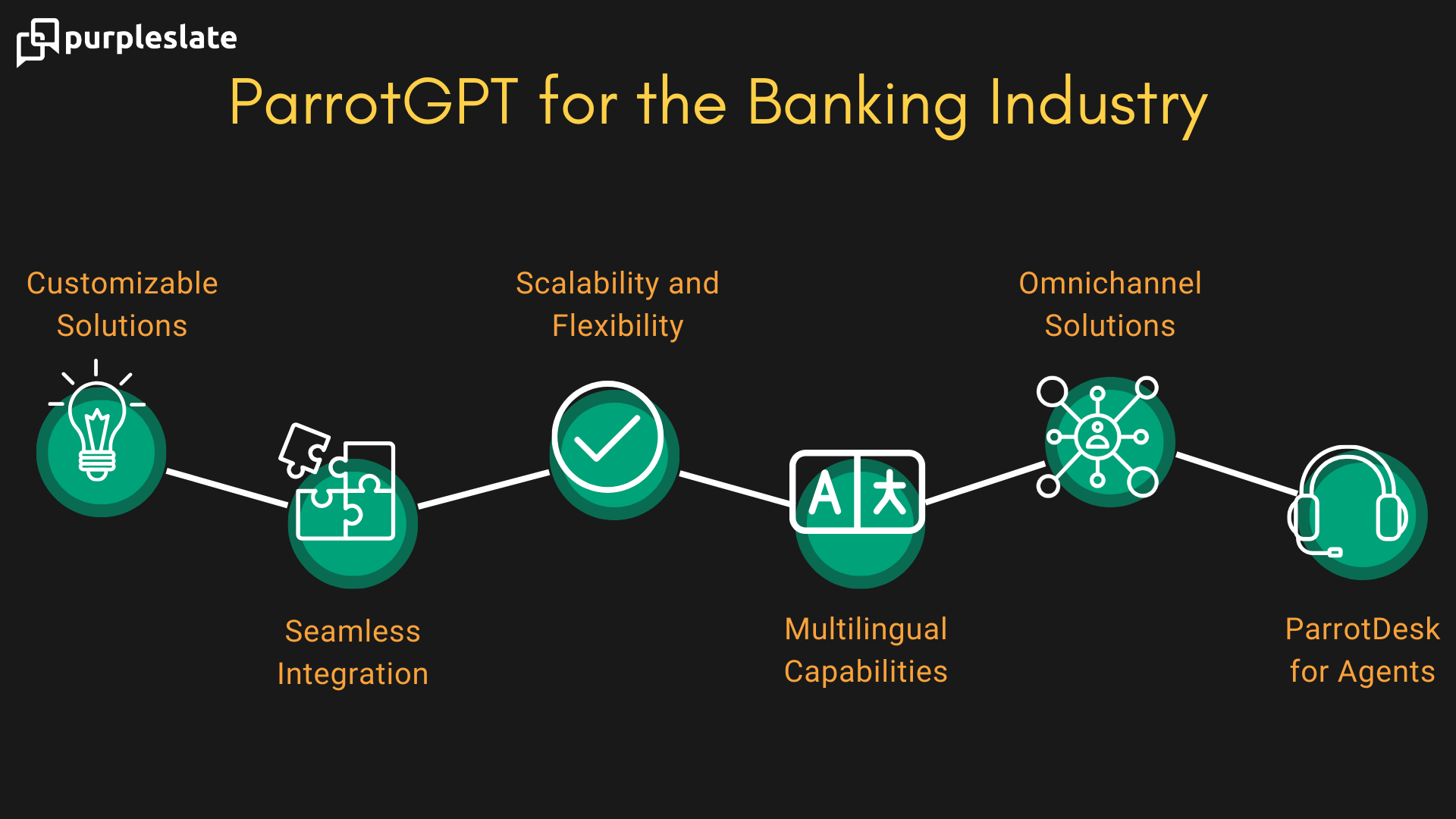

ParrotGPT: The Future of Gen AI-Powered Conversational Banking

As the banking industry continues to evolve in the digital age, the demand for advanced, user-friendly solutions has never been greater. Enter ParrotGPT, a leading Gen AI-powered conversational banking platform designed to revolutionize the way banks interact with their customers. With its state-of-the-art capabilities and customizable features, ParrotGPT is paving the way for a new era of conversational banking that prioritizes user engagement, personalization, and seamless integration.

Customizable Solutions

Recognizing that every bank has unique needs and objectives, ParrotGPT offers tailored chatbot solutions powered with advanced NLP that can be customized to align with specific banking requirements. Whether it’s integrating specific services, adapting to brand guidelines, or catering to particular customer segments, ParrotGPT’s customizable solutions empower banks to deliver a personalized user experience that resonates with their target audience.

Seamless Integration

One of ParrotGPT’s standout features is its seamless integration capabilities. Compatible with a wide range of existing banking systems and platforms, ParrotGPT ensures smooth and efficient integration without disrupting ongoing operations. This seamless integration allows banks to maintain a cohesive and streamlined user experience across all touchpoints, from online banking portals to mobile applications.

Scalability and Flexibility

Designed with scalability in mind, ParrotGPT’s architecture is flexible enough to accommodate the growing needs of banks of all sizes, from small community banks to large financial institutions. Whether scaling to meet increased demand, expanding service offerings, or adapting to market changes, ParrotGPT’s scalable platform ensures that banks can grow and evolve without constraints.

Multilingual Capabilities

ParrotGPT’s multilingual capabilities enable banks to reach a global audience by supporting multiple languages. This feature ensures inclusivity and accessibility, allowing banks to engage with customers from diverse linguistic backgrounds and enhance their global presence.

Omnichannel Solutions

ParrotGPT’s omnichannel solutions provide a unified and consistent customer experience across various channels, including web, mobile, and social media platforms. This omnichannel approach enables seamless transitions between different channels, ensuring continuity and coherence in customer interactions, regardless of the touchpoint.

Parrot Desk

Parrot Desk serves as the bridge between customers and customer service executives. When customers escalate from the bot, Parrot Desk facilitates the connection, allowing customer service agents to step in and address queries effectively. It comes packed with a lot of features including voice and video call connections to customers. This is especially useful in an industry where digital tellers still have a role to play.

Why DIY Doesn’t Work for Conversational Banking: The Need for Expertise

While the idea of developing an in-house chatbot may seem appealing, it often comes with significant challenges and limitations that can compromise the effectiveness and success of the initiative. This section explores why DIY approaches fall short and emphasizes the importance of partnering with experienced vendors for successful chatbot implementation.

Limitations of In-House Chatbot Development

Developing a chatbot in-house requires substantial investment in terms of time, resources, and expertise. Some of the key limitations of DIY chatbot development include:

- Lack of Specialized Skills: Building an effective chatbot requires specialized skills in AI, NLP, and machine learning, which may not be readily available within the bank’s existing team.

- Resource Constraints: In-house development can strain internal resources, diverting attention from core business operations and strategic initiatives.

- Scalability Challenges: DIY solutions may lack the scalability to accommodate growing user demands, leading to performance issues and system limitations over time.

- Maintenance and Updates: Ongoing maintenance and updates can be complex and time-consuming, requiring continuous monitoring and support to ensure optimal performance.

Risks of Poor Chatbot Implementation and User Experience

Poorly implemented chatbots can lead to:

- Decreased Customer Satisfaction: Ineffective chatbots can frustrate users with irrelevant responses and poor user experiences, leading to decreased customer satisfaction and loyalty.

- Lost Opportunities: Missed opportunities to engage customers effectively and provide personalized assistance can result in lost revenue and market share.

- Reputational Damage: A subpar chatbot can tarnish a bank’s reputation, affecting its credibility and trustworthiness in the eyes of customers and stakeholders.

Importance of Partnering with Experienced Vendors

Given the complexities and challenges associated with in-house chatbot development, partnering with experienced vendors offers a more viable and effective solution. Experienced vendors bring:

- Expertise and Knowledge: Vendors specializing in chatbot development possess the requisite expertise and knowledge to design, deploy, and optimize chatbots tailored to the banking industry’s unique requirements.

- Scalable Solutions: Experienced vendors offer scalable solutions that can adapt and grow with evolving business needs, ensuring long-term success and sustainability.

- Continuous Support: Vendors provide ongoing support, maintenance, and updates, ensuring that the chatbot remains up to date with the latest technologies and industry trends.

DIY approach may seem like a cost-effective option initially. But the complexities and challenges associated with chatbot development and implementation often outweigh the benefits. Partnering with experienced vendors like purpleSlate can provide banks with the expertise, scalability, and support needed to successfully navigate the intricacies of chatbot deployment, ensuring enhanced customer engagement, operational efficiency, and long-term success in the digital era.

Intrigued to get started on revolutionizing your bank with Gen AI Chatbots?