Business Value Achieved

- Brought down Partner Onboarding time by less than a day

- Increased the number of partner onboarding by 2X

- Detailed Status tracking and updates to Partners and customer punching policy and Renewal from Day 1

The Client – A Leading Insurance Provider

Our client is a leading service provider in the Indian health insurance sector with more than 17 years of experience having a national presence handling 1000+ branch offices. The client aims to be the largest health insurance provider ensuring financial security for healthcare management for the average Indian.

- Industry – Insurance sector

- Employee Strength – 13,000+

- Solution – Integration with Partners through a digital channel for onboarding for fresh Policy Issuance and Renewals

The Context – The Role of Partners/Brokers in Insurance

Partners or insurance brokers form an important facet of the Insurance ecosystem. They form an easier and more accessible bridge between the customer and the insurer. By definition, insurance brokers are middlemen between the insurance organization and their customers. They strive to understand the requirements of the customer and suggest the best insurance products that will satisfy their client’s needs. The Insurance Broker needs to get a license from the relevant regulatory authorities.

Hence, the partners generally deal with not just one but multiple insurance providers. The partners can be an individual or an organization. They explain the terms, inclusions, exclusions, and other relevant details of the insurance product the customer is purchasing.

The advantages of a partner ecosystem for the insurance sector are many. It can benefit both the customer as well as the insurer.

For a customer, the partners ensure:-

- Expert Advice: The customer need not look beyond an established insurance broker or partner for purchasing insurance. The partner will have deep knowledge of the insurance offerings and the customer’s needs, and will try to match them both.

- Trust: There have been instances where the claims outright rejected by the insurers got settled when a partner intervened. Thus the trustability of a partner is higher according to the customer.

- Cost-effective: The partner holds high bargaining capabilities and hence the customer knows that they will be able to bring in competitive premiums.

For an Insurer, the partners ensure:-

- Customer Relationship: A partner would interact with the customer more frequently to understand their concerns.

- Assured Business: A partner will have a better network of customers. Options to cross-sell and upsell to different customers are wider.

- Customer Retention: The partners provide end-to-end service for their customers in the insurance domain. Hence, they ensure customer retention for the insurers

The Case – Improving Partner Experience in Insurance Ecosystem

Getting a partner onboarded into their insurance domain was a gargantuan task for any insurance organization, and our client was no different. The due diligence, approvals, constant back and forth, the type of partner getting onboarded, and more lead to delays beyond the usual 30 days.

Partners also expect a seamless process where they want to have clean end-to-end integration with the insurer for payments, policy issuance, and more.

From the Partner’s perspective, their key responsibilities were the following. This is limited to those partners or brokers who have their own websites for insurance sales.

- Data Collection: Partners collect end-to-end data of the customer to be shared with the insurance company branch.

- Debit Amount: Assuming the partner has his own payment gateway, they can debit the amount from the customer.

- Inform Insurer: Pass on the details, and other information along with the premium to the insurer.

- Support: Any immediate queries and concerns of the customer regarding the policy were addressed by the partners.

We at purpleSlate proposed the entire process be integrated by routing everything through our already existing Digital Office solution.

Want to know more about the Digital Office Solution? Click here.

Digital Office solution has three use-cases which works on three major scenarios.

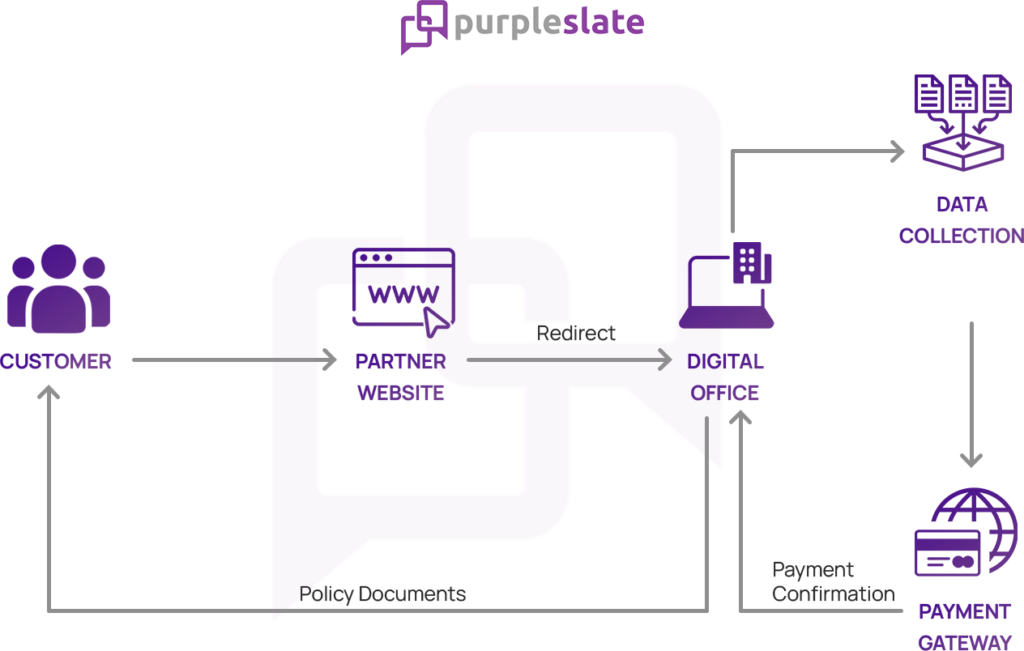

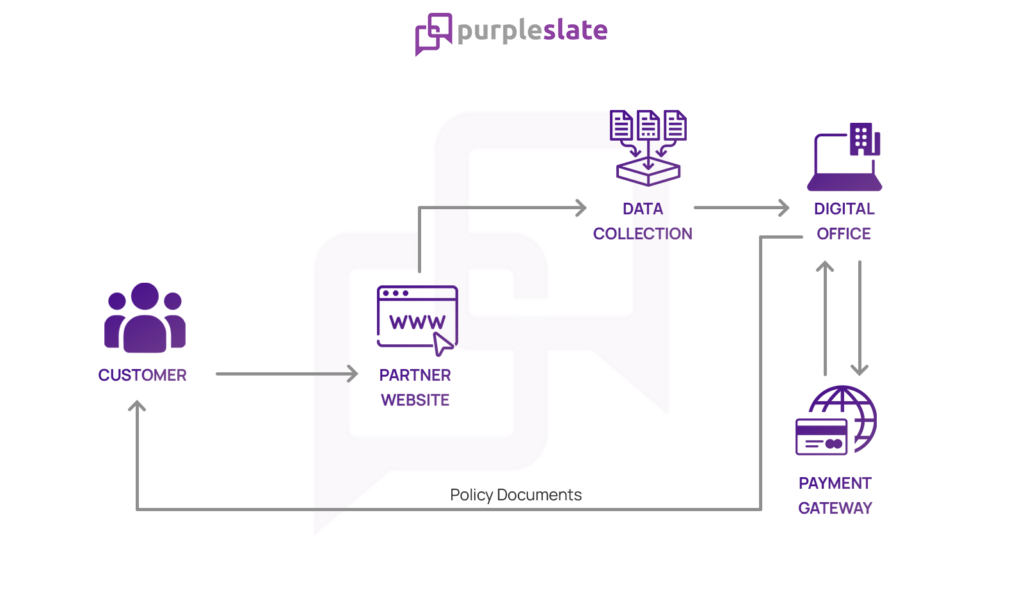

Scenario 1 – Partner Website Redirects to Digital Office

In this scenario, the partner website does not collect any data or process payment. The customer coming to the website of these partners will be immediately redirected to the insurer’s Digital Office. Data collection and payment processing happens in the Digital Office. Post payment confirmation, Digital Office will issue the policy to the customer.

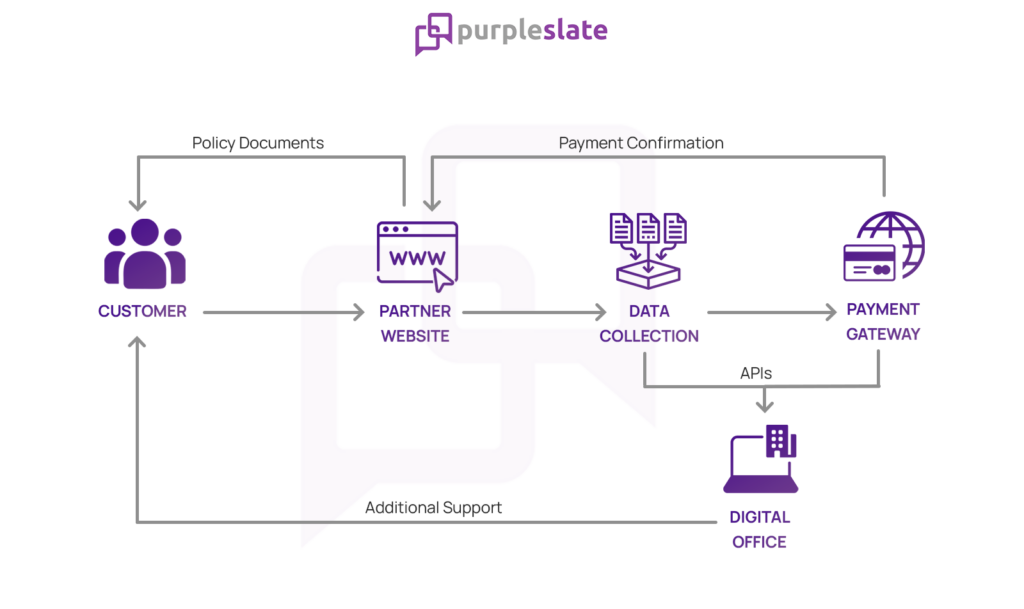

Scenario 2 – Partner Collects Data Only

In this scenario, the partner website only collects data. They redirect to Digital Office to process payment. The customer coming to the website of these partners will be redirected to the insurer’s Digital Office after data collection for payment. Payment processing happens in the Digital Office’s payment gateway. Post payment confirmation, Digital Office will issue the policy to the customer.

Scenario 3 – Partner Collects Data and Processes Payment

In this scenario, the partner website can collect data and process payment as they have their own payment gateway. The customer coming to the website of these partners will complete their entire insurance policy purchase journey from the same website. Digital Office will collect details using APIs at different stages. The customer can communicate with the Digital Office for additional Support.

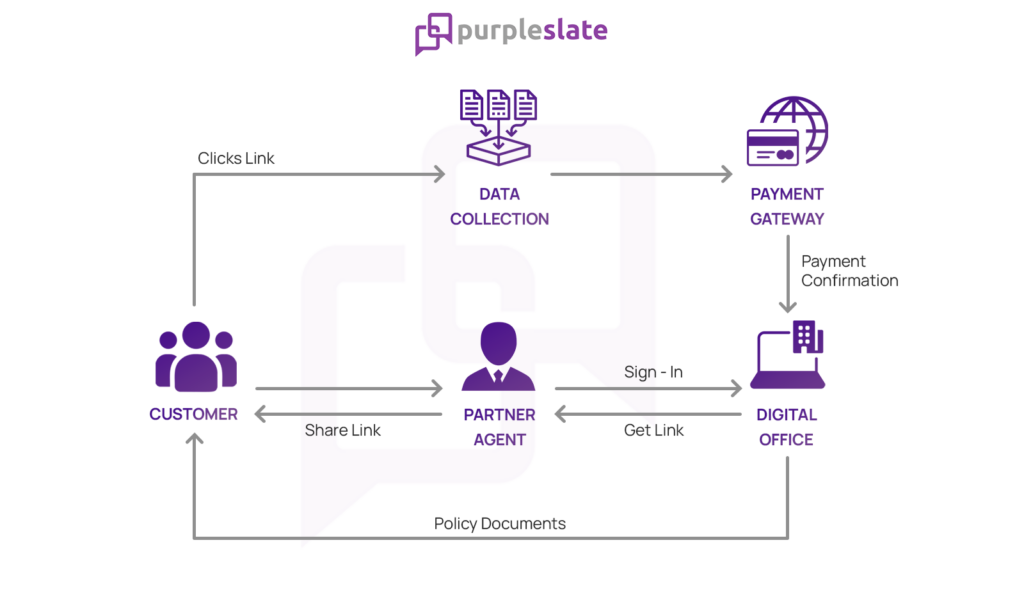

Additional Scenario – Agent from the Partner Signs a Client

In this scenario, an individual agent from the Partner website sells a policy to the customer. They will have individual credentials to login to the Digital Office and generate a link to share with the customers. The customer can click the link, input their data, and proceed for payment. Post payment confirmation, Digital Office will issue the policy.

The benefits of integrating with the partner website were many, but the two most advantageous propositions are outlined below.

- Single point of contact: Our Digital Office can communicate with the website of the partners and fetch the right information. In cases where the partners do not have their own website, they can redirect the customer to the insurer’s website from where data can be collected using the Digital Office.

- Single Source of Truth: Our Digital Office provides our client complete view of all the customer data solicited by their multiple partners in one place. This considerably reduces the complexity in commission payouts.

- Online Payments: The portal was provided with an online payment gateway with multiple aggregators offering all possible payment options. Partners who do not have their own payment gateway can depend on our Digital Office for initiating payments.

- 24/7 Support: Our Digital Office can be accessed by the partners 24/7 by the partners for any emergency requirements.

Creating a single point of contact for the partners proved to be a win-win. The onboarding process for the partners also came down drastically from 30 days to less than 24 hours. Additionally, this led to an increase in partners by 2X.