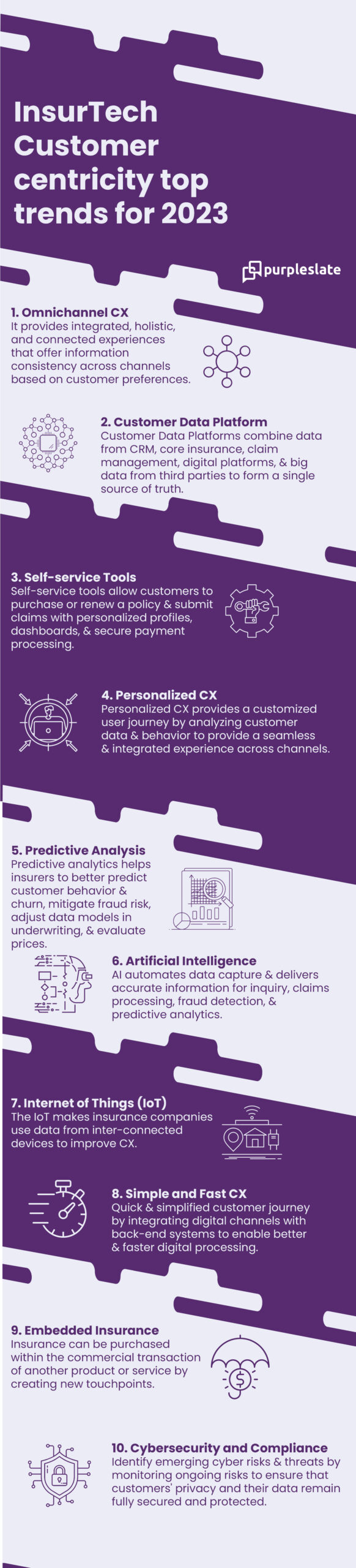

Customer-centricity is a fundamental approach that prioritizes the needs and wants of customers, aiming to provide them with timely and tailored solutions. In the insurance sector, the concept of “customer experience” encompasses the entire journey of a customer’s interaction with an insurance provider, from the initial awareness of the company and its products to the purchase and ongoing support and service they receive. Check out the below infographic to know more about Insurtech top trends for 2023.

Ensuring a positive customer experience is crucial for insurance companies as it can drive customer satisfaction, loyalty, and advocacy. By focusing on the customer’s perspective, insurance providers can better understand their expectations and deliver products and services that align with their needs.

To achieve customer-centricity, insurers need to emphasize personalized interactions, streamline processes, and leverage technology to enhance customer experiences. This includes leveraging data analytics to gain insights into customer preferences and behaviors, allowing insurers to tailor their offerings and communications accordingly.

Additionally, insurance providers must invest in efficient and user-friendly digital platforms to enable seamless interactions and transactions. Online self-service portals and mobile applications empower customers to access policy information, initiate claims, and receive support at their convenience.

Furthermore, customer-centricity entails proactive and responsive customer support. Timely and helpful communication, whether through traditional channels or emerging channels like chatbots or virtual assistants, can enhance the overall customer experience and address customer concerns promptly.

Insurance providers also need to focus on building long-term relationships with their customers. This involves ongoing communication, personalized offers, and proactive recommendations based on the customer’s evolving needs and life events.

While customer-centricity is a timeless concept, the insurance industry continues to evolve to meet the changing expectations of customers. InsurTech, the intersection of insurance and technology, plays a significant role in driving this evolution. It encompasses various innovations, such as artificial intelligence, data analytics, blockchain, and automation, that enable insurers to deliver enhanced customer experiences.

In conclusion, customer-centricity is vital in the insurance sector to meet customer expectations and provide a positive overall experience. By understanding and addressing customer needs at every stage of the journey, insurers can foster customer satisfaction and loyalty. Embracing technology and leveraging InsurTech innovations further enables insurers to deliver personalized solutions and streamline interactions, ultimately enhancing the customer experience.